How to Open a Line of Credit on Your House

We're reader-supported and may be paid when you visit links to partner sites. We don't compare all products in the market, but we're working on it!

{"menuItems":[{"label":"What is a line of credit and how can I use it?","anchorName":"#what-is-equity"},{"label":"How much does a line of credit home loan cost?","anchorName":"#line-credit-loan-cost"},{"label":"The benefits and drawbacks of borrowing home equity","anchorName":"#be-aware"},{"label":"How to compare and apply for a line of credit","anchorName":"#compare-apply-line-credit"},{"label":"More line of credit questions","anchorName":"#questions-answered"}]}

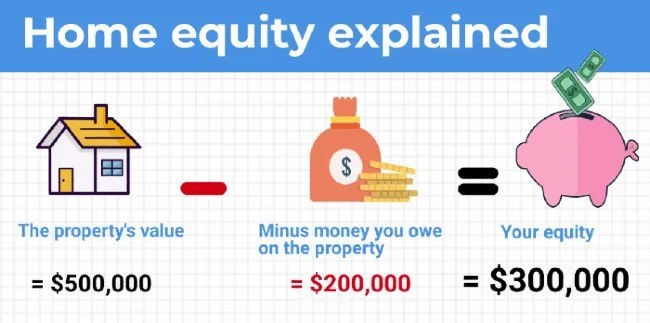

A line of credit (or a home equity loan) allows you to borrow money using the equity in your property.

Equity is the value of your home minus any money you owe on it. If your home is worth $500,000 and you owe $200,000 on your mortgage, then your equity is $300,000. Using a home equity loan, you can access some of that money (up to 80% of the property's total value) to spend on anything you want.

But are there any limits or guidelines about how you spend the money? And are there any risks?

Looking for a loan or need more information?

- Compare line of credit rates

- What is a line of credit and how can I use it?

- How much does a line of credit home loan cost?

- Benefits and drawbacks

- How to compare and apply

- More line of credit questions

What is a line of credit and how can I use it?

When you access money through a line of credit, it means you are withdrawing money from your home loan based on the amount of equity you have built up in the loan.

You can take out a line of credit and spend it on anything you like, from home renovations to a holiday to a car, or even to fund another property purchase or investment.

How much of my equity can I borrow?

Most lenders will lend you up to 80% of your property's value. Some will go up to 90% or even 95%, but an 80% limit is far more common. Using our example of a $500,000 loan with a $200,000 loan balance, this means you can borrow to up to 80% of the property's value.

- $500,000 x 80% = $400,000

- $400,000 - existing debt of $200,000 = $200,000

- Amount you can access through your line of credit = $200,000

Interest rate calculation

You only need to repay the amount you actually spend, not the total line of credit that the lender extends to you.

If you have a $200,000 line of credit and you spent $30,000 on a car, you would only pay interest on the $30,000, not the full $200,000.

How to use a line of credit loan to invest

Investors can buy an investment property by borrowing equity in an existing property. For example, if your property is worth $500,000 and your mortgage balance is $200,000, then you have $300,000 worth of equity. This is a substantial amount of money that can be used to fund the purchase of another property or invest in other assets, such as shares.

How much does a line of credit home loan cost?

Here's a breakdown of the potential costs of a line of credit loan:

- Interest charges. The lender charges interest, but remember this is only charged on the amount you spend, not on the total credit limit.

- Upfront fees. Many lenders charge an application fee. A valuation fee is quite common too. You may also have to pay a discharge fee when the loan ends.

- Ongoing fees. Some lenders charge a small monthly service fee instead of, or sometimes in addition to, the application fee.

Repayments

With many line of credit home loans, you don't have to make monthly or regular repayments. This gives you more flexibility. In many cases, you don't have to make repayments until you reach your credit limit.

Line of credit home loans are often interest only for the first few years, meaning you pay the interest charges now and repay the borrowed amount later.

This keeps your costs down, but if you continue doing this for a long time it could cost you a lot in interest.

The benefits and drawbacks of borrowing home equity

There are many benefits to withdrawing your equity if you need it, but any borrowing situation comes with risks that you need to know.

Benefits

- Accessibility. Line of credit loans are easier to obtain than other types of loans and credit cards.

- Flexibility. The funds can be withdrawn easily via cheque or an ATM card linked to the loan. Some lenders provide borrowers with the ability to withdraw funds through an online banking system or a telephone banking system.

- Additional repayments. Extra repayments on the loan can be made at any time, which can help reduce the amount of interest paid over the life of the loan.

- Low interest rates. One of the most attractive benefits of a line of credit loan is that it often has lower interest rates compared to other products such as personal loans or credit cards.

Drawbacks

- Difficult to manage. As it's easy to access the money and most line of credit loans involve a large amount of money, the borrower needs to be financially disciplined to manage this type of loan.

- Security. If the loan isn't repaid according to the terms of the contract, the lender can take the property as payment.

- Equity loss. Your equity is wealth. It's yours to use as you see fit, but keep in mind that by using it, you're reducing – hopefully temporarily – the value you have in your house.

- No end date. The flexibility of a line of credit can be a bad thing too. If you take a long time to repay what you've borrowed it could get expensive.

How to compare and apply for a line of credit

Comparing home equity loans is a little different to comparing traditional mortgages. You need to look at:

- Interest rate. The lower your rate the lower your repayments.

- Fees. The fewer the fees, the better.

- Borrowing amount. The amount you wish to borrow is an important consideration. Some lenders have fairly low maximum loan amounts, while others could lend you enormous sums of money (provided that you have the equity).

How do I apply for a line of credit equity loan?

If you're applying for a line of credit you may need to satisfy the following criteria or supply the following information:

- Name and address for each borrower

- Purchase date and price of your home

- Employment income

- Outstanding balance and monthly payment on current mortgage

- Estimated market value of your home

- Requested loan amount

- Photo ID for all borrowers

More line of credit questions

How can I minimise the interest I have to pay?

You can save money on the interest payable over the life of your loan by using your income to offset the loan amount. This can be done by depositing your income into the loan account and then withdrawing money as needed to satisfy your living expenses from the line of credit. With this method, the interest on the loan is only calculated on the remaining balance of the account, which will lower your interest charges.

How can I protect my home?

From a lender's point of view, it has the security of your home in the event you default on the loan. If your property declines in value, you will end up with less equity and you could even end up owing more on the loan than your home is actually worth. This is why it's a good idea not to borrow or use the full amount of equity available. Always leave a buffer.

How does a line of credit loan compare to a personal loan?

Line of credit loans typically have much lower interest rates than personal loans. If you're disciplined in paying off your line of credit, you could potentially save thousands of dollars in interest. Let's look at an example.

| Line of credit | Personal loan | |

|---|---|---|

| Borrowing amount | $10,000 | $10,000 |

| Length | 5 years | 5 years |

| Rate | 5% | 14% |

| Monthly repayment | $188.71 | $235 |

Over the course of the personal loan, you would pay $4,117 in interest. With a line of credit rate, you'd pay $1,322.74 in interest. That's a saving of more than $2,794 over 5 years.

However, this requires the discipline to repay your line of credit loan in a timely manner. If you ended up letting your line of credit loan stay open for 15 years, you would end up paying $4,234.29 in interest, eclipsing the amount you would have paid on a personal loan.

How to Open a Line of Credit on Your House

Source: https://www.finder.com.au/home-loans/line-of-credit-equity-loans

0 Response to "How to Open a Line of Credit on Your House"

Post a Comment